With the demise of third-party cookies, brands of all descriptions face the loss of targeting and performance insights vital to driving customer experience initiatives.

This signal loss puts an average of $91 to $203 million in revenue at risk every year across a range of industries, according to Deloitte research, making a strong business case driving the uptake of data clean rooms, or DCRs.

Some of the biggest brands in the world including Colgate-Palmolive, Kraft Heinz Company, Danone, Deliveroo and Renault are utilizing DCRs as a way to share and analyze different types of customer data while respecting user privacy. But challenges remain.

What do data clean rooms offer?

Data clean rooms are cloud-based environments where companies can share datasets on customers that have been aggregated and anonymized for a range of marketing and personalization activities.

Such is their growing popularity that Gartner predicted 80% of large-scale advertisers with annual media budgets of more than $1 billion would be using DCRs by 2023.

Broadly speaking, there are several different types of data clean rooms: DCRs available through the digital platforms like Google, Meta and Amazon; those available from large media and retail media companies such as Disney and NBCUniversal; and ones available through third-party providers such as LiveRamp, Snowflake and AppsFlyer.

DCRs have become an attractive solution for brands seeking privacy-compliant, cookie-less customer insights, and they support a multitude of use cases, including campaign measurement, audience building, attribution and activation across platforms.

When companies leverage DCRs to optimize CX, brands can compare notes on first-party data tranches they’ve collected to see the scope of their potential revenue opportunities, according to Ted Sfikas, field CTO with Amplitude. This in turn can improve measurement accuracy.

Data analysis conducted through DCRs can help brands reach people more effectively online, even in closed-off digital platforms, and helps their advertising to be more precise and better targeted, Sfikas said.

The end result is clearer CX priorities, improved strategies and more impactful customer journeys. Yet DCRs have some gaps. For instance, because the data in DCRs are aggregated and anonymized, brands don’t have the same in-depth knowledge of every customer attribute and trait, according to Sfikas.

“This is by design, as privacy compliance is the most important priority in these activities,” he said.

However, there are also challenges when it comes to employing DCRs and many brands are falling short of using DCRs to their full potential, according to IAB’s recent State of Data 2023 report.

IAB found that just over half of DCR users say leveraging results and proving ROI is a challenge. In addition, nearly 2 in 5 are also facing challenges with data interoperability and customization as well as internal resourcing when using DCRs, while one-third are struggling with privacy compliance.

For effective insights, DCRs need to integrate different data sources in a privacy-compliant manner, but this has yet to be achieved, underscoring the broader industry's struggle to create a unified approach to data privacy and interoperability.

“As we saw with Google’s monopoly on third-party data, some DCRs are not interoperable between platforms, which means only the marketers with access to whatever platform they exist on can use them,” Sfikas said.

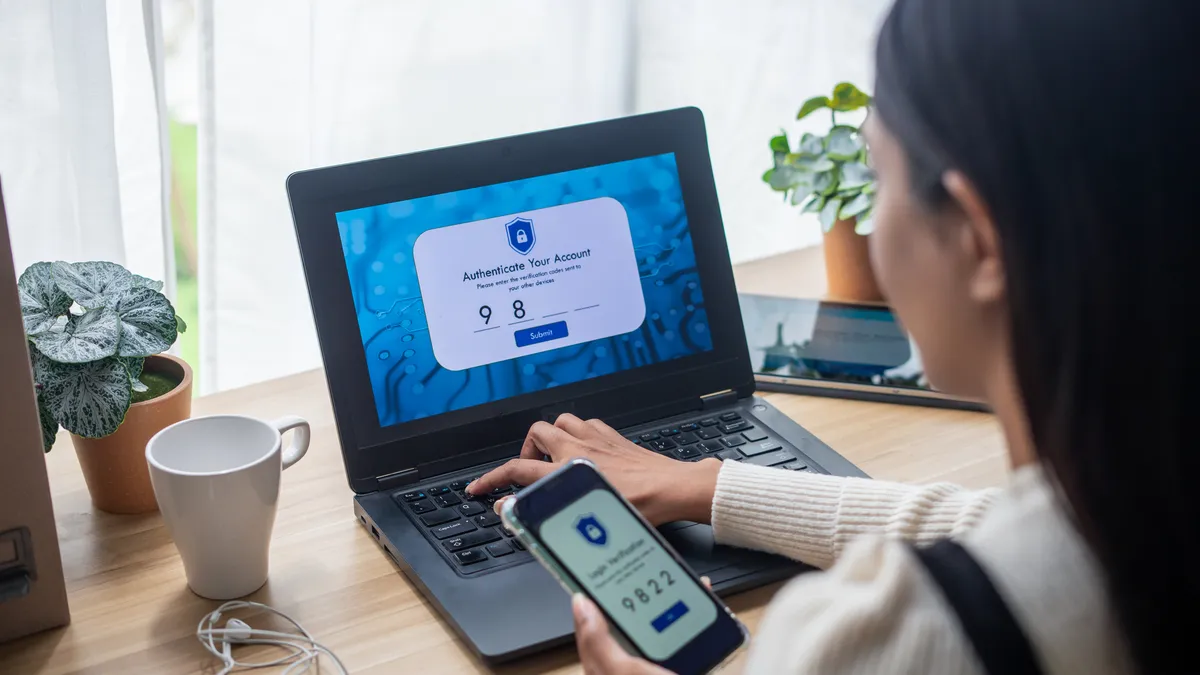

Progress is being made towards a universal ID framework that is compatible with different channels and devices, enabling advertisers seamless, privacy-compliant data analysis based on unique-to-user IDs. It offers promising opportunities for advertising and broader CX efforts.

“If CX teams can incorporate some of these new emerging methods into their audience designs, it will make data sharing and insights a worthwhile effort,” Sfikas said.

Clean rooms are most effective with well-defined parameters for the data analysis. In addition, security remains a concern, as human design and manual management may introduce the risk of unintended data exposure.

There are also cost considerations, although these can be overcome with scale, according to Kevin Bell, VP of data and analytics strategy at Vericast.

There’s also no standardized platform, which has created a crowded market where brands face significant upfront costs for strategic and tactical solutions, Bell said.

“The reality often falls short of the clean image advertised and requires meticulous configuration, including data agreements and explicit definitions of inputs and outputs,” he said.

Applications beyond privacy-compliant measurement

Despite some of the challenges, DCRs offer CX leaders cross-brand customer intelligence that can be applied to other parts of the business. “CX teams are going to encounter a treasure trove of insights that were previously inaccessible,” Sfikas said.

DCRs help brands to compare and contrast their customers’ experiences and activities with external websites and apps. This enables CX teams to develop complementary strategies across marketing, sales and customer success, he said.

“The knowledge gained from DCR activities applies to many stakeholders in the brand and will lead to new revenue opportunities through these partnerships,” Sfikas said.

DCR insights can be applied to omnichannel analysis and used to enhance loyalty programs, according to Bell.

They also allow brands to collaborate and derive insights without exposing sensitive information, thereby satisfying two essential criteria for successful CX — personalization and privacy.

“This fosters consumer trust by demonstrating a commitment to privacy and personalized services,” Bell said.

Correction: An earlier version of this article erroneously listed the wrong author. The byline has been updated.