When Giant Food unveiled its Giant Flexible Rewards loyalty program in March 2020, the COVID-19 pandemic was just beginning, grocery inflation was hardly noticeable and the supermarket chain’s approach to thanking people for their business was still heavily reliant on tried-and-true discounts on gasoline.

Four years later, with shoppers hyper-focused on price, the points-based program has evolved into a central tenet of the mid-Atlantic retailer’s broad-based strategy for connecting with customers by emphasizing a commitment to offering value while also guiding people to foods that will help them feel good about their grocery purchases.

Since January 2022, the Ahold Delhaize-owned supermarket company has provided double points on products included in Guiding Stars, the nutrition-rating program it uses to flag good-for-you items for customers, in a bid to encourage people to load up on healthy foods.

“Rewarding healthy options is just an amazing way to provide that emotional connection to customers and really show them that we take their health seriously and we care about them,” said Emily Massi, a registered dietitian who serves as manager of healthy living and merchandising for Giant.

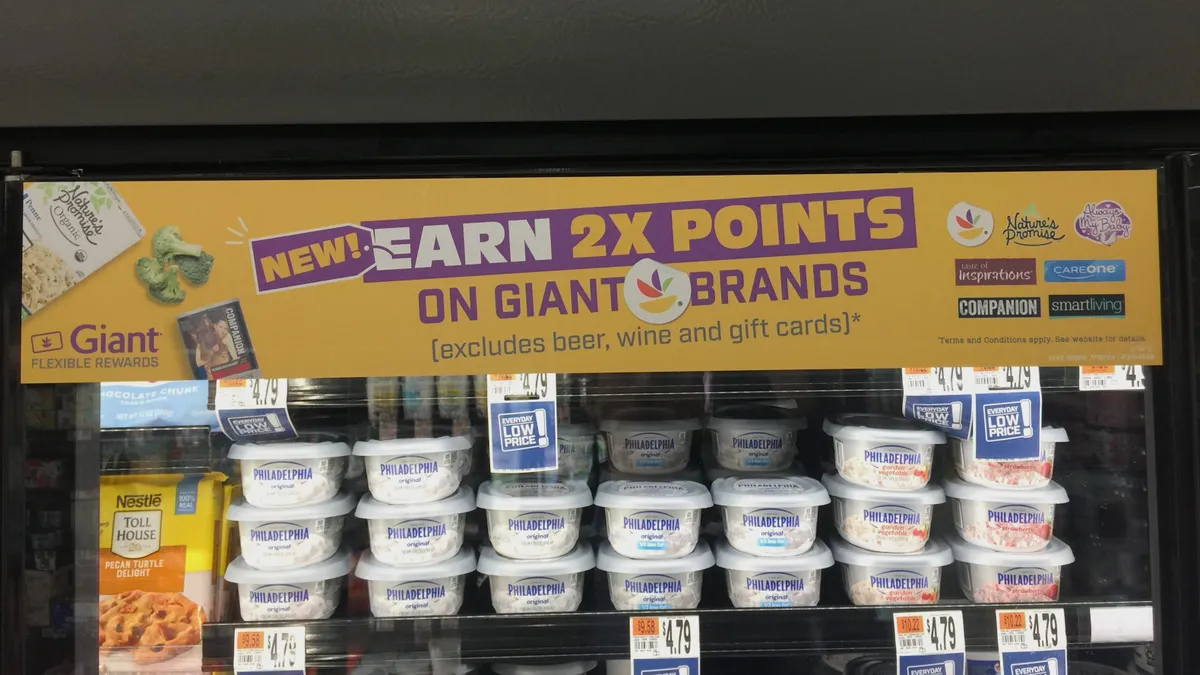

Last week, amid the continuing pressure discounters such as Aldi and Walmart are exerting on traditional supermarket operators, Giant retooled its loyalty program to encourage shoppers to buy more private label goods by providing double points on items carrying the grocer’s house brands, such as bread, milk, bottled water, frozen vegetables and cheese.

Giant said it has also lowered prices on many private label goods, and the company is using signage in its store to emphasize the price difference between items carrying its names and comparable national brand goods.

“We’re not just trying to sell [customers] things, but we’re actually trying to empower them … and reward them for what they’re doing to build that long-term relationship,” said Ryan Draude, the grocer’s director of omnichannel loyalty and CRM.

About half of Giant’s shoppers have a digital relationship with the chain, which runs just over 160 stores in Maryland, Virginia, Delaware and Washington, D.C., Draude noted.

Giant’s decision to incentivize private label purchases through its loyalty program follows its success in building digital relationships with shoppers by rewarding them for buying Guiding Stars-rated products, according to Draude.

The company has given out about 500 million points, which it values at $6 million, through the initiative, Draude said, noting that the retailer has covered that cost itself rather than with funding from suppliers.

About 115,000 households — representing a third of Giant Flexible Rewards’ membership base — take advantage of the nutrition-focused program every week, according to Draude. The promotion has also translated into stronger sales engagement, with households that opt in to the program boosting their weekly spending at Giant by an average of 6.5% while also making more trips to the company’s stores, he said.

Using rewards to connect with more shoppers

Giant is also reaping benefits by letting shoppers redeem a set number of points for goods like milk, eggs and rotisserie chickens, essentially making those goods available to shoppers without asking them to pay anything, Draude said. The majority of shoppers who take advantage of that program tend to visit Giant stores less frequently than other customers and spend less when they do come in, he said.

“The hypothesis that our team had was if the point levels are low enough that a casual shopper can build these balances and attain the value to redeem, then that type of casual shopper may be the primary user of the program,” said Draude, who led Choice Hotels International’s loyalty program before joining Giant Food. “The ones that are engaging in it the most are the ones that are most transient and have the most share of wallet available.”

Giant recently raised from 100 to 200 the number of points it requires people to turn in for milk and eggs, a change Draude said would help support the changes Giant has recently made to the rewards program’s structure. He added that the 300 points people need for rotisserie chickens translates into a discount because they would otherwise need more points to cover the $6.99 the grocer charges for the poultry.

Giant also allows shoppers to redeem small numbers of points for items that cost between about 75 cents and $1.25, like bagels and lemons, to make it easier for people who have accumulated relatively few points to derive value from the loyalty program.

“We keep looking to see where we might have opportunities to include items that are the highest-volume and the most needed by families,” said Natalia Duane, a loyalty strategy and CRM specialist for the company who helped launch the program.

Giant Food has also been making progress in an effort it began last September to encourage shoppers to provide their loyalty program information when picking up prescriptions at pharmacy counters — an area where people tend to be less likely to think about rewards tied to grocery purchases, Draude said. Through that initiative, the grocer provides people with 100 points for transactions such as filling prescriptions and receiving vaccines.

About 41% of Giant’s shoppers now present their loyalty program information when visiting Giant’s pharmacies, up from 35% when the program began, according to Draude. Giant is hoping to boost that figure to 50% by the end of the year, he added.

“The whole idea of being a one-stop shop was our mission with having that pharmacy relationship enacted. With grocery, with pharmacy and now with nutrition … we’re really rewarding across the store with any of the products and services that we offer to our customers.”