Dive Brief:

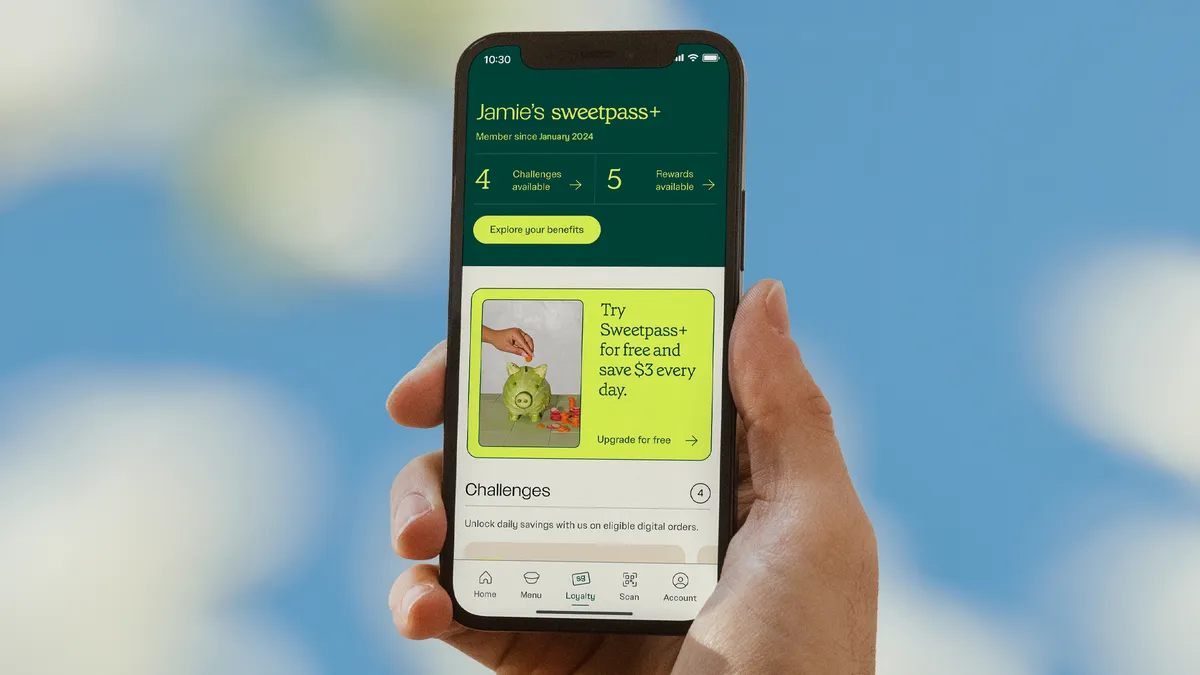

- Sweetgreen is adding an annual tier to its loyalty program, according to a press release emailed to Restaurant Dive on Thursday.

- The new tier costs $100 for a year of Sweetpass+, the equivalent of 10 payments for those on the monthly plan; the benefits are identical across the two paid tiers and are based around a core $3-a-day discount for paying members.

- Sweetpass+ has seen significant customer demand and that enrollment in the program grew 25% in the back half of 2023, said Michael Kotick, Sweetgreen’s VP, head of marketing.

Dive Insight:

Last April, Sweetgreen rolled out its rewards program nationally with the unpaid tier, Sweetpass, and the monthly paid tier, Sweetpass+. The addition of the yearly payment option for Sweetpass+, a 16.7% discount compared the monthly tier, could incentivize further adoption while also giving Sweetgreen a hefty upfront payment for membership. The loyalty program initially applied only to digital orders, but last summer the company announced it would add the ability to redeem rewards on in-store orders.

The free tier offers unspecified perks, rewards and challenges, bowl and merch drops, and a birthday gift. All those rewards are available as well to paying members. Members of all tiers have access to several popular digital exclusive bowls, including the Elote Bowl, Buffalo Chicken Bowl, Fish Taco Bowl and Super Green Goddess Bowl.

While not an update to its core program, Sweetgreen’s annual payment option does align with the restaurant industry’s trend toward tiers and broader or more personalized rewards. In general, those are differentiated by consumer spending rather than the timing of a subscription payment.

As restaurants compete on value perceptions to drive traffic, the rewards, and associated costs, offered by loyalty programs may become a weightier factor in consumer choices. Starbucks’ most recent quarterly results demonstrated the utility of a strong brand connection fostered by loyalty. The coffee chain’s occasional customers dropped off from the chain in November and traffic remained soft into January, but rewards members increased both spend and frequency — generally offsetting the decline in traffic. Such loyalty can insulate chains from temporary slowdowns.